October 2024

Feature Articles This Month

- Boost Morale and Save Taxes with Achievement Awards

- The Rise of Check Kiting and Other Check Fraud

- When is Employer-Paid Life Insurance Taxable?

Tax Tips

- An IRA Withdrawal Strategy with Tax-Reducing Power

- Factoring the QBI Deduction into Year-End Tax Planning for Your Business

- Added Protection for Your Personal and Financial Information

QuickBooks Tips

- Preparing to Reconcile Accounts in QuickBooks? 5 Tips to Make it Easier

Any accounting, business or tax advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties. If desired, we would be pleased to perform the requisite research and provide you with a detailed written analysis. Such an engagement may be the subject of a separate engagement letter that would define the scope and limits of the desired consultation services.

Boost Morale and Save Taxes with Achievement Awards

Some small businesses struggle with employee morale for a variety of reasons, one of which may be economic uncertainty. If you want to boost employees’ spirits without a big financial outlay, an achievement awards program is a relatively low-cost fringe benefit that may be a win-win addition.

Under such an initiative, you can hand out awards at an appointed time, such as a year-end ceremony or holiday party. And, as long as you follow the rules, the awards will be tax-deductible for your company and tax-free for recipient employees.

Fulfilling the requirements

To qualify for favorable tax treatment, achievement awards must be granted to employees for either promoting safety in the workplace or length of service. The award can’t be disguised compensation or a payoff for closing a big deal. In addition, they must be tangible items, ranging from a gold watch or a smartphone to a plaque or a trophy. Examples of awards that would violate the rules are gift certificates, vacations, or tickets to sporting events or concerts.

Additional requirements apply to each type of award:

1. Safety awards. These can’t go to managers, administrators, clerical workers or other professional employees. Also, safety awards won’t qualify for favorable tax treatment if the company grants them to more than 10% of eligible employees in the same year.

2. Length-of-service awards. To receive such an award, an employee must have worked for the business for at least five years. In addition, the employee can’t have received a length-of-service award within the last five years.

Also keep in mind that the award must be part of a “meaningful presentation.” That doesn’t mean you have to host a gala awards dinner at the Ritz, but the award should be marked by a ceremony befitting the occasion.

Nonqualified vs. qualified

There are limits on an award’s value depending on whether the achievement awards program is nonqualified or qualified. For a nonqualified program, the annual maximum award is $400. For a qualified program the maximum is $1,600 (including nonqualified awards). Any excess above these amounts is nondeductible for the employer and taxable to the employee. If an employee receives multiple awards in one year, these figures apply to the total, not to each individual award.

To establish a qualified program, and therefore benefit from the higher limit, you must meet two additional requirements. First, awards must be granted under a written plan and the plan must be open to all eligible employees without favoritism. Second, the program must not discriminate in favor of highly compensated employees as to eligibility or benefits. For 2024, the salary threshold for a highly compensated employee is $155,000.

Awards of nominal value are generally not taxable. These are small, infrequent gifts such as a coffee mug, a t-shirt or an occasional meal.

Explore the idea

If an achievement awards program makes sense for your company, be sure that these requirements are met. Otherwise, you and your employees could suffer negative tax consequences. Contact the office for guidance in setting up a program that checks all the boxes.

The Rise of Check Kiting and Other Check Fraud

While the use of paper checks has greatly diminished, thieves still view them as a source for stealing revenue. In fact, the Financial Crimes Enforcement Network warns that many thieves are returning to old-fashioned financial theft, using paper checks. That’s one reason why the U.S. Postal Service urges us to not send checks through the mail, where they may be vulnerable.

“Check kiting” is another type of check fraud to be aware of. It relies on “float time.” That’s the period of delay between when a check is deposited in a bank and when the bank collects the related funds. In recent years, float time has narrowed, but it hasn’t disappeared. Unethical employees can use float time to falsely inflate an account balance, allowing checks that would otherwise bounce to clear. This type of crime usually involves multiple banks or multiple accounts in the same bank.

Strategies for Thwarting Check Fraud

Here are five strategies you can implement to keep people from using your company’s accounts for fraudulent activity, including check kiting.

1. Educate employees about bank fraud. Teach them to recognize fraudulent transactions and related red flags. Workers who are aware of suspicious activities can bolster management’s commitment to preventing fraud.

2. Rotate key accounting roles. Segregate accounting duties. By rotating tasks among staffers, if possible, you can help uncover ongoing schemes and limit opportunities to steal.

3. Reconcile bank accounts daily. Make sure someone trustworthy, who isn’t involved in issuing payments, reconciles every company bank account.

4. Maintain control of paper checks. Store blank checks in a locked cabinet or safe and periodically inventory the blank check stock. Also limit who’s allowed to order new checks.

5. Go digital. The most effective way to prevent check fraud is to stop using paper checks altogether. Consider replacing them with ACH payments or another form of electronic payments.

Tighten Up

The bottom line is, it’s a mistake to assume that check fraud is too old-fashioned to attract the attention of thieves.

Vigilance in your banking processes can help thwart it. For help tightening your internal controls, contact the office.

When is Employer-Paid Life Insurance Taxable?

If the fringe benefits of your job include employer-paid group term life insurance, a portion of the premiums for the coverage may be taxable. And that could result in undesirable income tax consequences for you.

The cost of the first $50,000 of group term life insurance paid by your employer is excluded from taxable income. But the employer-paid cost of coverage over $50,000 is taxable to you and included in the taxable wages reported on your Form W-2, even if you never actually receive any benefits from it. That’s called “phantom income.”

Have you reviewed your W-2?

If you’re receiving employer-paid group term life insurance coverage in excess of $50,000, check your W-2 to see the impact on your taxable wages. If there’s a dollar amount in Box 12 (with code “C”), that’s the amount your employer paid to provide you with group term life insurance over $50,000, minus any amount that you paid for the coverage. You’re responsible for any taxes due on the amount in Box 12, including employment tax.

The amount in Box 12 is already included as part of your total “Wages, tips and other compensation” in Box 1 of the W-2. It’s the amount in Box 1 that’s reported on your tax return.

What are your options?

If the tax cost seems too high for the benefit you’re getting, ask your employer if they have a “carve-out” plan, which allows certain employees to opt out of the group coverage. If there’s no such option, ask your employer if they’d be willing to create one.

Carve-out plans vary, but one option is for your employer to continue to provide $50,000 of group-term coverage at no cost to you. Your employer could then provide you with an individual permanent policy for the balance of the coverage. Or it could pay you a cash bonus representing the amount it would have spent for the excess coverage, and you could use that money to pay premiums for an individual policy. There would still be tax consequences, but the tax liability might be smaller and the coverage might better meet your needs.

We can help

You may have other tax questions about life insurance. Feel free to contact the office for answers.

An IRA Withdrawal Strategy with Tax-Reducing Power

As the year winds to a close, your chance to lower your 2024 tax bill also winds down. If you’re age 70½ or older, you may want to make a qualified charitable distribution (QCD) from your IRA before year end. Normally, distributions from a traditional IRA are taxable. But the amount of your QCD is removed from your taxable income, which may preserve your eligibility for other tax breaks. It also can fulfill your annual required minimum distribution, if applicable.

A QCD can’t be claimed as a charitable contribution deduction. But, depending on your other potential itemized deductions, the standard deduction may save you more tax.

If you’re eligible, you can make a QCD up to $105,000 in 2024. For your QCD to be tax-free, it must be paid from your IRA custodian or trustee directly to an IRS-approved charity. Don’t take chances. Contact the office to nail down the details.

Factoring the QBI Deduction into Year-End Tax Planning for Your Business

Thanks to the Tax Cuts and Jobs Act, sole proprietors and owners of pass-through entities, such as partnerships, S corporations and, generally, limited liability companies, may be able to claim tax deductions based on their qualified business income (QBI) and certain other income.

This deduction can be up to 20% of your QBI, subject to limits that apply at higher income levels. However, some tax planning strategies can increase or decrease your allowable QBI deduction for 2024. So if you’re eligible for this deduction, it’s important to consider the impact other year-end strategies will have on it before executing them. Also keep in mind that the QBI deduction is scheduled to expire at the end of 2025 unless Congress acts to extend it.

Contact the office for help optimizing your overall tax results.

Added Protection for Your Personal and Financial Information

Protection is key when guarding your personal and financial information from fraudsters. That’s why the IRS offers a vital tool, the Identity Protection Personal ID Number (IP PIN). The IP PIN is a six-digit number you can apply for voluntarily. It’s known only to you and the IRS. It’s valid for one year, and you’ll automatically be given a new one after expiration.

To apply for an IP PIN, you must have a Social Security Number or Individual Taxpayer ID Number. You also must verify your identity to the IRS.

Suppose you file your tax return with an incorrect IP PIN. The return will be rejected, or the IRS will reach out to validate the information. For more on IP PINs: https://www.irs.gov/identity-theft-fraud-scams/frequently-asked-questions-about-the-identity-protection-personal-identification-number-ip-pin

Preparing to Reconcile Accounts in QuickBooks? 5 Tips to Make it Easier

If you had to make a list of your least favorite financial chores, bank account reconciliation would undoubtedly be on it. No one likes reconciling. But what good does it do to have QuickBooks tell you your account balances if there’s a chance they’re not accurate?

QuickBooks’ ability to import your bank account transactions makes this process easier than the old checkbook register and calculator method. Because you can see transactions once your bank has cleared them, you can do some of your prep work on an almost daily basis, rather than having to do everything at the end of the month.

Many Benefits

There are numerous benefits to using QuickBooks’ reconciliation tools beyond knowing that your QuickBooks balance is accurate. For example, you can:

- Monitor your accounts for unauthorized access,

- Ensure that your bill payments have cleared,

- Match invoices to payments, and,

- Find errors before they can cause significant problems.

But before you begin the actual reconciliation process in QuickBooks, there are steps you should take so your work session goes as smoothly as possible. Here are five tips.

1. Make Sure You Have QuickBooks Accounts Set Up for All of Your Real-Life Bank Accounts.

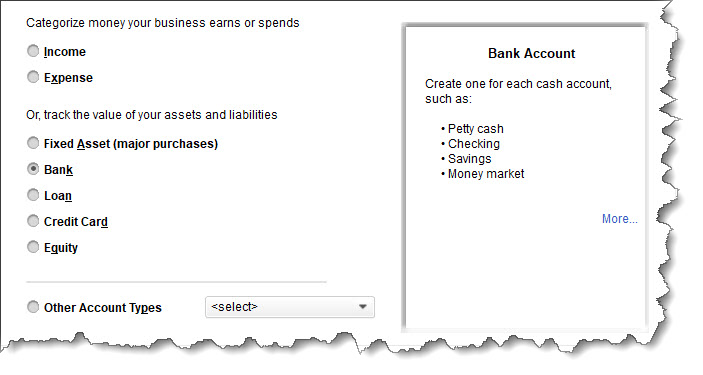

Open the Company menu and select Chart of Accounts. Click the down arrow next to Account in the lower left corner and select New to open a window that looks like this:

If you’re reconciling your checking account(s), for example, click the button in front of Bank, then click Continue. Complete the fields in the window that opens and save the account.

WARNING: It’s very important that you enter the correct Opening Balance, which should be printed on the statement you’re about to reconcile. After you’ve gone through the process once, QuickBooks will automatically enter this number.

2. Check to See That You’ve Entered All Cleared Transactions in QuickBooks

If you’ve been importing transactions online, do a final download of cleared transactions from your bank account. You can get a jump on reconciliation by ensuring that you’ve entered everything in QuickBooks that has been imported within the period you’re going to reconcile. Look carefully for deposits and payments, because these tend to be missed more often than other transactions. Enter anything in QuickBooks that’s missing.

3. If You Don’t Download Transactions, Gather All Your Financial Papers

It will be more time-consuming to reconcile an account if you’re not importing your account data from your financial institutions. So to save time during the actual process, make sure you have all the paper that documents your income and expenses, including deposit slips, your checkbook register, pay stubs (anything that is related to money you’ve received or sent). You might set up monthly folders to keep all these documents together.

4. Don’t Forget About Service Fees and Interest

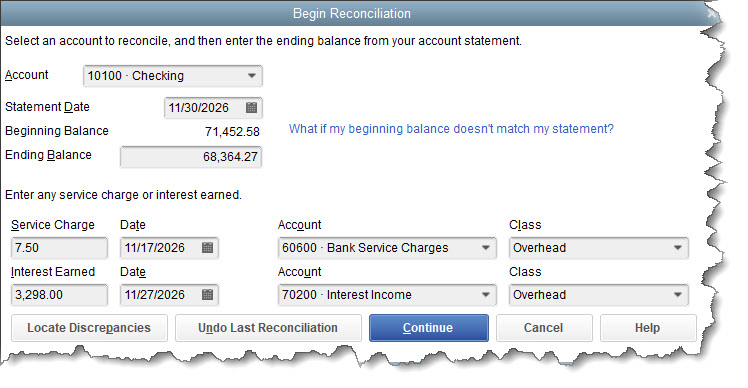

Yes, these might seem like miniscule amounts, but it only takes a missing penny for a reconciliation to fail. Don’t forget to enter them as you follow QuickBooks’ step-by-step instructions. The window pictured below will open when you eventually open the Banking menu and click Reconcile.

5. Back Up Your QuickBooks Company File Before You Start to Reconcile

You should be doing this regularly anyway (at least every third time you open QuickBooks), but definitely do it before you reconcile an account. Open the File menu and click Back Up Company. You’ll choose between Create Local Backup (to a USB drive, for example) and Setup/Activate Online Backup. The latter requires a subscription to Intuit Data Protect, which is included with QuickBooks Desktop Pro Plus and Premier Plus and can be added for an additional cost if you’re not using one of those versions.

A Monthly Challenge

While it’s true that the mechanics of the process get clearer with repetition, you can still run into difficulties getting the difference between your QuickBooks account and your bank statement to equal zero. If you’d like, contact the office to talk about having us play a more active role in your accounting chores.

Upcoming Tax Due Dates

October 15

Individuals: File a 2023 income tax return (Form 1040 or Form 1040-SR) if an automatic six-month extension was filed (or if an automatic four-month extension was filed by a taxpayer living outside the United States and Puerto Rico). Pay any tax, interest and penalties due.

Individuals: Make contributions for 2023 to certain existing retirement plans or establish and contribute to a SEP for 2023 if an automatic six-month extension was filed.

Individuals: File a 2023 gift tax return (Form 709) if an automatic six-month extension was filed. Pay any tax, interest and penalties due.

Calendar-year bankruptcy estates: File a 2023 income tax return (Form 1041) if an automatic six-month extension was filed. Pay any tax, interest and penalties due.

Calendar-year C corporations: File a 2023 income tax return (Form 1120) if an automatic six-month extension was filed. Pay any tax, interest and penalties due.

Calendar-year C corporations: Make contributions for 2023 to certain employer-sponsored retirement plans if an automatic six-month extension was filed.

Employers: Deposit Social Security, Medicare and withheld income taxes for September if the monthly deposit rule applies.

Employers: Deposit nonpayroll withheld income tax for September if the monthly deposit rule applies.

October 31

Employers: Report Social Security and Medicare taxes and income tax withholding for third quarter 2024 (Form 941) and pay any tax due if all of the associated taxes due weren’t deposited on time and in full.

November 12

Individuals: Report October tip income of $20 or more to employers (Form 4070).

Employers: Report Social Security and Medicare taxes and income tax withholding for third quarter 2024 (Form 941) if all of the associated taxes due were deposited on time and in full.